User researchers are an inquisitive lot, no matter in which part of the world they work. However, there is diversity in the research discipline in different parts of the world. The practice of user research in Asia has grown significantly in the past few years. Large organizations, tech SMEs and startup unicorns are aggressively recruiting UX talent, increasingly in short supply. “Why should I hire you?” today sounds like an obsolete question when hiring for UX roles.

Researchers and project teams in Asia are experiencing higher than ever stakeholder buy-in for conducting user research. The recent shift to “all things remote” behavior has led all UXers to make an involuntary shift into gathering feedback remotely. Cloud-based collaborative design and user testing platforms such as Figma, Miro, Usertesting.com, UXArmy, dscout, etc. have become the UX work essentials.

However, despite the COVID-19 work-from-home model, usage of remote research tools and platforms in Asia remains limited. This is reflected in a survey of around 100 researchers and designers in Asia conducted by UXArmy. 25% of respondents reported research experience ranging between 8 to 20 years, while over 40% had research experience ranging between 3 to 8 years. The remaining reported less than 3 years’ experience.

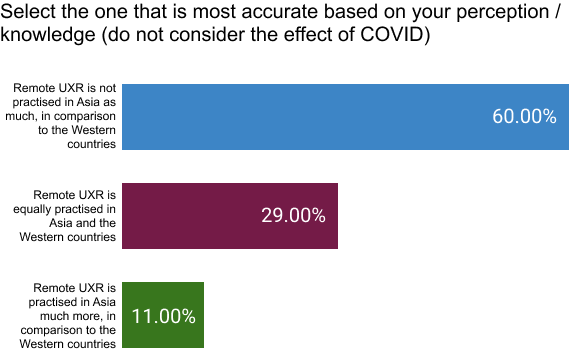

Sixty percent of all survey respondents agreed with the statement that “Remote UXR is not practiced in Asia as much, in comparison to the Western countries.” This article will discuss current user research practices in Asia and make the case for incorporating more remote research as standard practice.

FIg 1. Researchers in Asia self-report conducting less remote research compared to those in the West

Current practice of user research in Asia

The majority of user research leaders in Asia come predominantly from UX Design and market research backgrounds. Few leaders have transitioned from non-UX roles like market research, analytics, product owners, project managers, etc. The responsibilities for these roles naturally required a need to make sense of user feedback and take action on it. Most people in these roles had close interaction with end user behavior in the product development process. Prior to 2010, most companies in Asia did not have a dedicated user researcher role. Instead, UX designers doubled up as researchers when required. After 2010, with the prolific adoption of digitalization in the industry, companies wanted to de-risk their investments resulting in higher demand for specific user researchers.

At junior and entry levels, a near majority of user researchers are likely to have a formal education in research-related fields or have experience doing usability testing. Newer roles at mid-senior level in the industry are now demanding user researchers to have formal education in a field related to user research (psychology, sociology, anthropology, etc.), and sound knowledge of statistics.

While budgets allocated to user research have been increasing, they remain small in comparison to design budgets. A meager 4% of those who responded to the survey said their organization’s user research budgets exceed 10% of the product development budgets. User research budgets are typically a part of Product development or Design budgets but may also come from marketing or be a separate ad hoc allocation.

FIg 2. User Research budgets are seldom dedicated; most are taken from the Product development or Design budgets

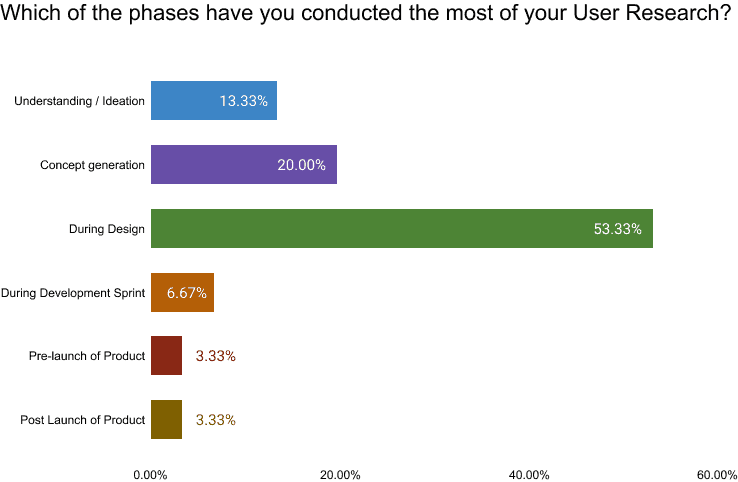

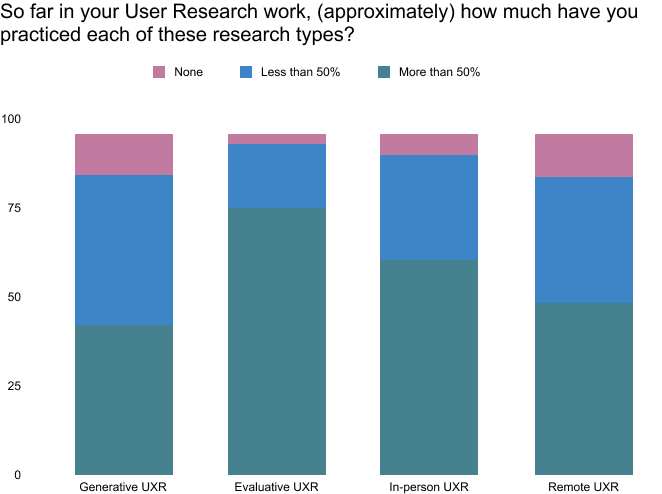

A good majority of the UX Research happening in Asia is design-focused, pre-launch usability testing, or competitive benchmarking. Much of evaluative user research is planned to align with development Sprints. User validation of early-stage concepts is gradually increasing in frequency. Due to less tangible outcomes and no proven method of calculating ROI, the application of longer-term generative user research to identify latent user needs, understand user behavior or ideate new product opportunities remains low, or in some organizations, even non-existent.

Fig 3. Most User research in Asia happens during the product design phase

Only a handful of organizations like banks, start-up “unicorns,” and global behemoths like Google or Meta (Facebook) are investing in long-term user research in Asia. The researchers’ effort-spend chart supports the observational indication that less than 5-8% of the total UX research efforts in Asia are spent on long-term generative user research. To clarify any discrepancy, the “Understanding / Ideation” measure in the graph above includes the generative research that happens as part of the Discovery phase in the product development lifecycle.

Fig 4. Most of the user research in Asia is still evaluative and executed in-person

Current usage of remote user research platforms in Asia

While the remote user research platform market is hot worldwide, in Asia, usage is highly fragmented. Preferences for the range of tools available vary depending on user role and desired output. While some tools have been created for and in-market, the usage of remote research platforms remains miniscule in countries like Mainland China, Japan and Korea.

Many researchers in Asia are attracted to online research platforms that produce a quick collection of usability metrics along with graphs like Heatmaps. However, the benefit of usability metrics alone seems to pale in comparison to the platforms that provide video clips of participants using the product and sharing feedback.

Researchers focused on usability testing appreciate metrics-driven platforms, while qualitative researchers tend to prefer platforms supporting screen and video recording. For most countries in Asia, especially Southeast Asia, users are not comfortable with face recording during an Unmoderated Test. For remote user interviews, turning on the Webcam is considered normal, especially when participants are offered substantial incentives.

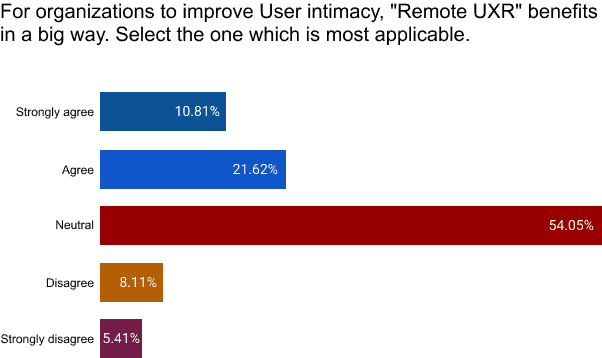

Despite the possibilities of remote platforms, as discussed, usage is still not high across Asia. Only 30% of researchers agreed with the statement: “For organizations to improve User intimacy, Remote UX Research benefits in a big way.” Compare this to the large selection of a neutral answer which could be heavily biased due the new normal set by the coronavirus pandemic.

This suggests remote research is not a preferred mode of user research in Asia, as a majority of respondents are not sold on remote research platforms as being robust or providing enough value from an output standpoint.

Fig 5. Remote User research is not seen to play a significant role in improving User intimacy

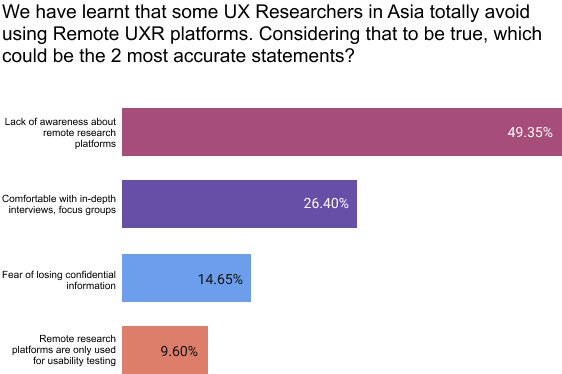

A significant percentage of user researchers in Asia also report low awareness about their options for remote platforms as a reason why they are not choosing these tools as an option.

Fig 6. Lack of awareness and comfort level in using traditional methods are the top two reasons to avoid using of Remote UXR platforms

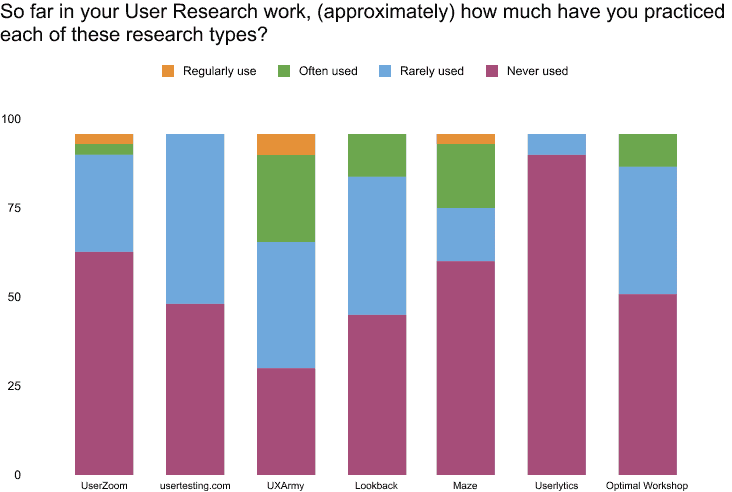

The following is a list of platforms reported by the participants of the survey. This list is in no specific order and no recommendation of any specific platform is being made.

UserZoom

Used by large enterprise customers in Singapore, Malaysia.

usertesting.com

Used by large enterprise customers, mainly in Singapore.

UXArmy

Used by a mix of large enterprise customers, Small and Medium Enterprises (SMEs), and startups in Singapore, Malaysia, Indonesia, Thailand and Australia.

Lookback

Used by large enterprise customers, mainly for remote user interviews as an alternative to ZOOM, Microsoft Teams, Google Meet, etc.

Maze Design

Used primarily by designers and design researchers in SMEs and tech startups. Popular s in Malaysia and Indonesia.

Optimal workshop

Used for Information Architecture research by large enterprise customers The Card Sorting tool is hugely popular across all of Asia.

Userlytics

Reported as the most rarely used tool in Asia.

Fig 7. Popularity of select Remote UXR platforms tools in Asia

The case for using remote user research in Asia

To clear the air, here is a disclaimer. I do not recommend a complete switch to remote user research. Ethnographic research in real-life environments remains one of the most effective and least biased research methods. Irrespective of user interviews, diary studies, field studies or any other research methods used, the “DO“ / “DOES” part in the Empathize phase of Design thinking is critical to be able to identify and define the problem to be solved.

However, remote user research methodologies have a role to play as the demand for research grows in Asia and teams .

The following highlights some compelling reasons for project teams, UX designers, and researchers in Asia to include remote user research in their product development lifecycle.

#1 Research Recruitment is a top challenge

Asia is the most diverse continent. The variations in geographical landscape, weather, culture, language, and income levels present a huge business opportunity. The eleven time zones in Asia create a tremendous challenge to schedule user research interviews in multi-country projects. A popular joke in my research circle is: “To confuse a researcher, get them to schedule user interviews with participants from Bangkok, Ho Chi Minh City, Kuala Lumpur, Jakarta and Bali.” Those cities are in four different time zones and include participants speaking four to five distinct languages.

Another difficulty in finding research participants for products with a target market across Southeast Asia is the varying communication language. In Thailand, Vietnam, Indonesia, and Myanmar the majority of people have a very strong preference to write and speak in their local language. While English is popular in the Philippines and Malaysia, it is common that people speak with an abrupt mix of local language and English.

Fig. 8 Illustration of a few of the several language scripts in Asia

Unlike the Euro in the Eurozone, there is no common currency in Asia. Asia has over 40 different currencies, with each country having their own. With so much diversity, research recruitment and scheduling of user interviews is best handled if automated. This makes a clear case for automated recruitment platforms which provide end-to-end recruitment services including screening, scheduling and distribution of incentives. This is a gap that remains to be addressed by technology and remote research platform creators.

#2 Growth of research teams calls for a remote research platform

Aligned with digitization and digital transformation initiatives, many businesses in Asia have been aggressively building in-house research teams. The outsourcing of research to UX consultancies has notably reduced. The UX consultancies are still engaged to augment the in-house UX research teams to secure unbiased feedback avoiding “Déformation professionnelle”. The planning of most user research studies typically starts 3 weeks ahead. However, projects with business backing can start with little notice due to the push from stakeholders for some quick decision making. On the other hand, less user-centric organizations require months for internal convincing and decision making to proceed with projects involving user research.

Team sizes in large organizations and tech startups vary vastly. Sometimes the ratio of UX personnel to Engineer ratio in tech startups can be higher than those in large organizations. Personally, I have seen and heard of team sizes in large organizations ranging between 5 to 20 user researchers. Researchers, designers, copywriters and research ops members comprising a UX team can exceed 100 members in a handful of organizations.

With UX teams getting larger and new user researchers joining the workforce, productivity has taken the spotlight. ROI of user research attracts a greater scrutiny from the top management.

Since the time and budgets are never infinite, UX teams cannot grow indefinitely to keep up with the required scale and demand coming. The management and UX leaders have recognized this limitation, and therefore the remote research platforms are being adopted more readily.

While many user researchers may be more comfortable doing in-depth interviews and online surveys, the timeline to deliver insights from usability testing during development needs to align with development Sprints. The agile model of development hardly leaves a time margin to properly plan an execution of research using the traditional user research methods. As businesses in Asia are no exception to this reality, either the research is selectively conducted for some Sprints or research teams have resorted to using a cloud-based user research platform.

#3 Need gaps in existing Remote UX Research platforms

Top need gaps reported by researchers who are already using remote tools include:

- Access to participants matching screening requirements; more variation in behavioral attributes of participants than offered in the existing marketing user panels

- Availability of platforms offering automated participant recruitment

- Integration with existing design tools, online repositories for research, and (client-provided) user panels

- Accommodation of technical limitations of participants. e.g. poor internet connection, lower tech savviness, fear of installing malicious software

- Localization in existing platforms, e.g. language translations

- Setting clear expectation on information received from remote unmoderated testing; depth of participant responses from unmoderated studies is not comparable to those from moderated interviews

Conclusion

By nature, Asia is fast moving. Being ahead of the pack to win titles and rewards is admired in Asian culture. Creating a great user experience demands a longer-term outlook as the ROI of user research is not always immediately visible. That is one of the potential reasons why the practice of user research had a delayed start in Asia. In some countries like Japan and Korea, technology teams still drive UX decision making.

Research in Asia is changing fast with rapid digitalization. More and more prominent businesses from the West are setting up offices in Asia to benefit from a “not to be missed” opportunity. Emerging tech unicorns like Grab, Carsome, Ninjavan, Carro, Traveloka, VNG, Lineman wongnai, CRED, Zerodha, are making headlines. Large organizations based out of Asia have also stepped up their design budgets. They are setting up user research teams in the quest of creating products that are highly relevant to the target audience and deliver a superior user experience.

Researchers in Asia have high expectations from the remote research platforms and are currently underserved. The variety in language, geographies, and user attributes like literacy gaps and income presents a huge challenge to the creators of remote platforms looking to market to the researcher community in Asia. With challenge comes the opportunity, and the companies building remote research platforms stand a good chance to be among the next wave of startup unicorns.

Kuldeep Kulshreshtha has over 25 years of experience building digital products and is the founder of UXArmy, a UX research company and Asia's first remote user research platform.

Pre-COVID, he was a frequent traveler throughout Asia, where he networked with hundreds of UXers and learned about variations in their behavior.